Introduction to Project Cost Control

Effective project management hinges on meticulous cost control to ensure projects are completed within budget, on time, and to specifications. Cost control in projects involves tracking budgets, forecasting expenses, and mitigating financial risks. This guide will explore 40 essential project cost control formulas, their applications, and real-world examples to provide project managers and financial analysts with the tools they need to maintain financial integrity throughout the project lifecycle.

1. Total Project Cost (TPC)

Formula: TPC = Direct Costs (DC) + Indirect Costs (IC)

Purpose: To aggregate all direct and indirect project expenses, providing a comprehensive view of the total expenditure.

Application: Used in the initial budgeting phase of constructing a new residential development to ensure all potential costs are accounted for and tracked.

Real-World Example: Calculating TPC for a bridge construction project where direct costs include materials and labor, and indirect costs cover project management fees and administrative support.

When to Use: At the beginning of the project planning process and throughout to update and monitor total expenditures.

2. Direct Costs

Formula: Direct Costs = Labor Costs (LC) + Material Costs (MC) + Equipment Costs (EC)

Purpose: To precisely quantify costs directly associated with the physical construction or production in a project.

Application: Essential in manufacturing to track the cost of raw materials, labor hours spent on assembly, and usage of machinery.

Real-World Example: Estimating the direct costs for a software development project, including developer wages (labor costs), software licenses (materials), and server use (equipment).

When to Use: During the detailed budgeting phase and for ongoing cost tracking in project execution.

3. Indirect Costs

Formula: Indirect Costs = Overhead Costs (OC) + General & Administrative Costs (G&A)

Purpose: To account for expenses not directly tied to specific project outputs but necessary for supporting overall project operations.

Application: Used to budget for costs like security services, rental of office space, and utilities in a large construction project.

Real-World Example: Calculating indirect costs in a large IT project, including project management software subscriptions and administrative salaries.

When to Use: In both the budgeting and execution phases to ensure all supportive activities are funded.

4. Overhead Costs (OC)

Formula: OC = Utilities + Rent + Depreciation + Taxes

Purpose: To cover ongoing operational expenses that support the project environment.

Application: Planning budgets for maintaining a project site, including utility bills for the site office, rent, and equipment depreciation.

Real-World Example: Tracking overhead costs in a multi-year infrastructure project, including office space rental and utilities at the site office.

When to Use: Throughout the project to manage non-direct costs and ensure they remain within allocated budgets.

5. General & Administrative Costs (G&A)

Formula: G&A = Salaries + Insurance + Office Supplies

Purpose: To manage general expenses associated with administering a project.

Application: Budgeting for salaries of administrative staff, insurance premiums for liability coverage, and office supplies in a corporate project.

Real-World Example: Allocating funds for administrative staff salaries and insurance in a healthcare facility expansion project.

When to Use: Primarily during the budget preparation phase and for ongoing administrative cost tracking.

6. Labor Costs (LC)

Formula: LC = Wage Rate × Hours Worked

Purpose: To determine the total cost of manpower for a project based on hours worked.

Application: Critical for calculating the direct labor expenses in projects where human resources play a significant role, such as construction or software development.

Real-World Example: Calculating the labor costs for electricians in a commercial building project based on their hourly rates and total hours worked.

When to Use: Throughout the project, especially in planning and tracking phases, to ensure labor costs align with the budget and project timelines.

7. Material Costs (MC)

Formula: MC = Quantity of Material × Unit Cost of Material

Purpose: To calculate the total expenditure on materials based on quantity needed and cost per unit.

Application: Essential for budgeting the cost of raw materials in manufacturing, construction, or any project requiring significant material inputs.

Real-World Example: Estimating material costs for a landscaping project, including the number of plants needed and the price per plant.

When to Use: Primarily in the budgeting phase to plan material expenses and during the project to adjust forecasts based on actual usage.

8. Equipment Costs (EC)

Formula: EC = Depreciation + Maintenance + Operating Costs

Purpose: To account for the costs related to equipment usage, including upkeep and operation.

Application: Used to budget for machinery use in projects requiring significant equipment, such as in construction or large-scale manufacturing.

Real-World Example: Calculating the cost of using a crane on a construction site, including its rental cost, maintenance, and fuel.

When to Use: During both planning and execution phases of a project to ensure equipment-related expenses are captured and controlled.

9. Budgeted Cost of Work Scheduled (BCWS)

Formula: BCWS = Planned Value (PV)

Purpose: To forecast the budgeted financial performance of project work scheduled to date.

Application: Used to set financial expectations for work scheduled within a specific reporting period, ensuring alignment with the overall project plan.

Real-World Example: Determining the BCWS for an IT system upgrade project by calculating the planned value of tasks scheduled for the first quarter.

When to Use: At the beginning of each project phase or cycle to establish baseline financial targets against which actual performance can be measured.

10. Planned Value (PV)

Formula: PV = % Complete × Budget at Completion (BAC)

Purpose: To measure the value of work that should have been completed at any given point in time according to the project schedule.

Application: Fundamental for progress reporting in project management, providing a benchmark for evaluating schedule adherence and financial control.

Real-World Example: Assessing the planned value in a software development project by calculating the expected completion of coding tasks against the total budget.

When to Use: Regularly throughout the project lifecycle to monitor schedule performance and adjust plans as needed to stay on track.

11. Budget at Completion (BAC)

Formula: BAC = Original Budget + Approved Change Orders

Purpose: To update the total project budget to reflect approved changes, providing a current benchmark for project completion costs.

Application: Crucial for managing the evolving nature of project finances, especially in projects susceptible to scope creep or frequent modifications.

Real-World Example: Revising the budget for a software implementation project after adding new features based on stakeholder feedback, which necessitated additional funds beyond the initial estimates.

When to Use: Whenever changes to the project scope are approved that impact the budget, ensuring the BAC is always reflective of the current expected total expenditures.

12. Actual Cost of Work Performed (ACWP)

Formula: ACWP = Actual Costs (AC)

Purpose: To track the actual expenditures on project work performed to date, providing a real-time snapshot of financial consumption.

Application: Essential for comparing actual spending against both the budgeted cost and the earned value to identify cost overruns or savings early.

Real-World Example: Monitoring the actual costs incurred during the construction phase of a residential development project, including labor, materials, and equipment expenses.

When to Use: Continuously throughout the project to monitor financial performance and implement corrective actions when actual costs deviate from planned budgets.

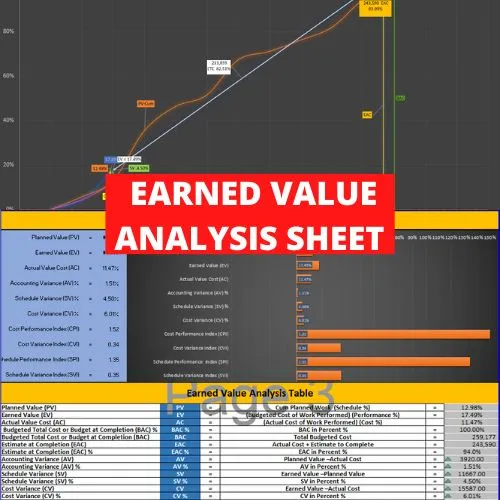

13. Earned Value (EV)

Formula: EV = % Complete × Budgeted Cost of Work Performed (BCWP)

Purpose: To assess the value of work actually completed compared to the planned budget, offering a quantifiable measure of project performance.

Application: A cornerstone of Earned Value Management (EVM), used to integrate cost, schedule, and scope; providing a comprehensive view of project health.

Real-World Example: Calculating the earned value for a road construction project where 50% of the work is completed, and the BCWP is estimated at $500,000, making the EV $250,000.

When to Use: Regularly during project reporting periods to gauge whether the project is on track financially and to forecast future performance trends.

14. Cost Variance (CV)

Formula: CV = EV – AC

Purpose: To identify discrepancies between the earned value and the actual costs, highlighting whether the project is over or under budget.

Application: Used to measure financial performance and control project costs by comparing what has been achieved to what has been spent.

Real-World Example: In a software upgrade project, if the earned value is $200,000 but the actual cost is $250,000, the CV would be -$50,000, indicating a cost overrun.

When to Use: At each financial reporting interval to facilitate timely decision-making and enable corrective measures to manage the budget effectively.

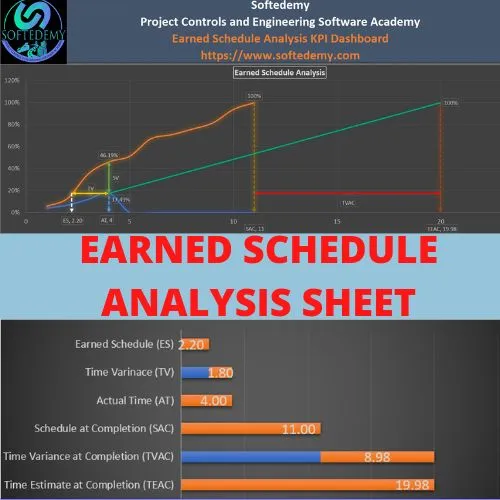

15. Schedule Variance (SV)

Formula: SV = EV – Planned Value (PV)

Purpose: To compare the earned value against the planned value, indicating whether the project is ahead of, on, or behind schedule.

Application: An essential component of performance measurement that helps project managers gauge the temporal efficiency of their projects.

Real-World Example: For a new product development project, if the EV is $75,000 against a PV of $80,000, the SV would be -$5,000, signaling a schedule delay.

When to Use: Used alongside cost variance in routine project reviews to provide a comprehensive overview of both cost and schedule performance, enabling proactive management of timelines and budgets.

16. Cost Performance Index (CPI)

Formula: CPI = EV / AC

Purpose: To determine the cost efficiency of the project work by comparing the value of work performed to the actual costs.

Application: A key indicator in Earned Value Management (EVM) used to evaluate how well a project is sticking to its budget.

Real-World Example: In a commercial building project, if the earned value (EV) is $300,000 and the actual costs (AC) are $320,000, the CPI would be 0.9375, indicating that for every dollar spent, only 93.75 cents worth of value is being realized.

When to Use: Regularly throughout the project lifecycle to monitor cost efficiency, enabling proactive budget management and cost control strategies.

17. Schedule Performance Index (SPI)

Formula: SPI = EV / PV

Purpose: To assess the efficiency of project progress relative to the planned schedule.

Application: Utilized to determine how well a project is progressing in terms of its timeline compared to the plan.

Real-World Example: If a project has an earned value (EV) of $200,000 and a planned value (PV) of $210,000, the SPI would be 0.952, suggesting the project is progressing at 95.2% of the rate planned, indicating a slight delay.

When to Use: As part of regular performance reviews to ensure that the project remains on or is able to return to its scheduled timeline.

18. Estimate at Completion (EAC)

Formula: EAC = BAC / CPI or EAC = AC + ETC

Purpose: To forecast the expected total cost of the project at its completion, considering current performance and expenditure.

Application: Critical for projects where scope and funding may adjust over time, allowing for updated completion cost estimates.

Real-World Example: For a project initially budgeted at $500,000 but with a current CPI of 0.8, the EAC would be calculated as $625,000, indicating expected cost overruns.

When to Use: When significant deviations from the budget are observed, to provide stakeholders with a realistic projection of total project costs.

19. Variance at Completion (VAC)

Formula: VAC = BAC – EAC

Purpose: To predict the potential budget variance at the project’s end, offering insights into overall financial performance.

Application: Used to anticipate whether the project will finish under, over, or on budget.

Real-World Example: If the original budget at completion (BAC) is $400,000 and the estimate at completion (EAC) is projected to be $450,000, the VAC would be -$50,000, indicating an expected budget overrun.

When to Use: This metric is crucial for mid-project reviews to adjust strategies and communicate potential budget issues to stakeholders.

20. To-Complete Performance Index (TCPI)

Formula: TCPI = (BAC – EV) / (BAC – AC)

Purpose: To calculate the cost performance that needs to be achieved for the remaining portion of the project to meet a specific financial target.

Application: Offers a forward-looking measure, especially useful in projects experiencing cost overruns or underperformance.

Real-World Example: If a project has a BAC of $1,000,000, an EV of $400,000, and AC of $500,000, the TCPI for completing the project within the original budget would be 1.2, indicating that future work must be performed 20% more efficiently financially.

When to Use: Particularly useful when project performance is deviating from the plan, allowing managers to set realistic performance targets for remaining tasks.

21. Cost Estimation Formula

Formula: Y = a + bX, where Y is the estimated cost, a is the fixed cost, b is the variable cost per unit, and X is the number of units.

Purpose: To calculate estimated costs based on fixed and variable components for unit-based projects.

Application: Used extensively in manufacturing and construction projects to estimate total costs based on production levels or units of output.

Real-World Example: Estimating the total cost of producing 10,000 units of a new product, where fixed costs (a) are $50,000, and variable costs (b) per unit are $5.

When to Use: During the planning and budgeting phases to forecast project costs accurately and adjust plans based on production levels.

22. Break-Even Point (BEP)

Formula: BEP = Fixed Costs / (Selling Price per Unit – Variable Cost per Unit)

Purpose: To calculate the sales quantity needed to cover all costs and start generating profit.

Application: Crucial for determining the financial feasibility of launching new products or services and setting sales targets.

Real-World Example: Calculating the break-even point for a new software application, where fixed costs are $200,000, the selling price per unit is $100, and the variable cost per unit is $40. The BEP would be 3,334 units.

When to Use: In the initial planning and feasibility analysis to understand the minimum sales required to avoid losses.

23. Return on Investment (ROI)

Formula: ROI = (Net Profit / Cost of Investment) * 100

Purpose: To measure the percentage return on the funds invested in the project.

Application: Used to evaluate the profitability of various investment opportunities and compare the efficiency of different projects.

Real-World Example: Calculating the ROI for a new marketing campaign where the net profit generated is $50,000 and the cost of investment is $20,000, resulting in an ROI of 250%.

When to Use: After project completion or periodically during the project to assess financial performance and justify continued investment.

24. Gross Profit Margin (GPM)

Formula: GPM = (Revenue – Cost of Goods Sold) / Revenue * 100

Purpose: To determine the percentage of revenue that exceeds the cost of goods sold, indicating the profitability of product sales.

Application: Essential for assessing the efficiency of production and the overall profitability of sales operations.

Real-World Example: Calculating the GPM for a retail business with $500,000 in revenue and $300,000 in cost of goods sold, resulting in a GPM of 40%.

When to Use: Regularly, to monitor and improve profit margins by controlling production costs and pricing strategies.

25. Net Profit Margin (NPM)

Formula: NPM = Net Profit / Revenue * 100

Purpose: To gauge the percentage of revenue that remains as profit after all expenses are deducted.

Application: Used to measure overall profitability and financial health of a project or business.

Real-World Example: Determining the NPM for a consulting firm with a net profit of $100,000 and revenue of $500,000, resulting in an NPM of 20%.

When to Use: Periodically, to evaluate the financial success of a project and inform strategic decisions regarding cost management and revenue enhancement.

26. Contribution Margin (CM)

Formula: CM = Revenue – Variable Costs

Purpose: To calculate the profit margin on sales after variable costs are covered, aiding in pricing and profitability analysis.

Application: Crucial for determining the profitability of individual items or services and for break-even analysis.

Real-World Example: Calculating the CM for a product with $150,000 in revenue and $90,000 in variable costs, resulting in a CM of $60,000.

When to Use: During pricing strategy development and financial planning to ensure products are priced to cover costs and generate desired profits.

27. Margin of Safety (MOS)

Formula: MOS = Current Sales – Break-even Sales

Purpose: To measure how much sales can fall before a project or company reaches its break-even point.

Application: Used to assess the financial safety buffer and risk level in sales volume.

Real-World Example: Calculating the MOS for a business with current sales of $500,000 and a break-even point of $300,000, resulting in an MOS of $200,000.

When to Use: In risk assessment and financial planning to understand and mitigate the risk of declining sales.

28. Cash Flow Formula

Formula: Cash Flow = Cash Inflows – Cash Outflows

Purpose: To monitor the net flow of cash into and out of a project to ensure liquidity.

Application: Essential for managing day-to-day financial operations and ensuring the project has sufficient funds to meet its obligations.

Real-World Example: Tracking the cash flow of a construction project, considering payments received from clients and expenses paid for materials and labor.

When to Use: Continuously, to ensure positive cash flow and prevent liquidity issues.

29. Working Capital Formula

Formula: Working Capital = Current Assets – Current Liabilities

Purpose: To assess the short-term financial health by comparing liquid assets against due liabilities.

Application: Used to measure a company’s ability to cover short-term obligations with its short-term assets.

Real-World Example: Calculating the working capital for a manufacturing firm with current assets of $1,000,000 and current liabilities of $700,000, resulting in a working capital of $300,000.

When to Use: Regularly, to ensure the company maintains sufficient liquidity to operate smoothly.

30. Payback Period (PP)

Formula: PP = Initial Investment / Annual Cash Inflow

Purpose: To determine how long it will take for an investment to pay back its original cost.

Application: Used to evaluate the time required to recover the initial investment in a project.

Real-World Example: Calculating the payback period for a solar panel installation with an initial investment of $100,000 and annual savings of $25,000, resulting in a PP of 4 years.

When to Use: In investment decision-making to assess the attractiveness of different projects based on their payback times.

31. Discounted Payback Period (DPP)

Formula: DPP = Initial Investment / (Annual Cash Inflow * Discount Factor)

Purpose: To measure the time to recoup the initial investment with the present value of cash inflows, considering the time value of money.

Application: Enhances the traditional payback period by accounting for the time value of money, providing a more accurate assessment of investment recovery time.

Real-World Example: Calculating the DPP for an investment in new machinery with an initial cost of $200,000 and annual cash inflows of $50,000, considering a discount rate of 5%.

When to Use: In financial planning and investment analysis to account for the diminishing value of future cash flows.

32. Net Present Value (NPV)

Formula: NPV = Σ (Future Cash Flow / (1 + i)^n) – Initial Investment

Purpose: To calculate the difference between the present value of cash inflows and outflows over the project’s life.

Application: Used to evaluate the profitability of an investment by considering the time value of money.

Real-World Example: Calculating the NPV of a five-year project with expected annual cash inflows of $100,000 and an initial investment of $300,000, using a discount rate of 10%.

When to Use: In capital budgeting to assess the potential profitability of new projects or investments.

33. Internal Rate of Return (IRR)

Formula: IRR is the discount rate that makes NPV = 0

Purpose: To identify the discount rate at which the present value of future cash flows equals the initial investment.

Application: Used to evaluate the profitability of potential investments and compare different projects’ financial viability.

Real-World Example: Determining the IRR for a real estate development project to compare against the company’s required rate of return.

When to Use: In investment analysis to make informed decisions about capital allocation.

34. Cost of Capital (WACC)

Formula: WACC = (E/V * Re) + (D/V * Rd * (1 – Tax Rate))

Purpose: To assess the cost of a company’s financing sources: equity and debt.

Application: Used to determine the average cost of capital, helping in evaluating investment opportunities and strategic financial planning.

Real-World Example: Calculating the WACC for a company with a mix of debt and equity financing to assess the cost of new capital projects.

When to Use: In financial management to ensure that the return on investments exceeds the cost of capital.

35. Return on Investment (ROI)

Formula: ROI = (Net Profit / Cost of Investment) * 100

Purpose: To measure the percentage return on the funds invested in the project.

Application: Used to evaluate the profitability of various investment opportunities and compare the efficiency of different projects.

Real-World Example: Calculating the ROI for a new marketing campaign where the net profit generated is $50,000 and the cost of investment is $20,000, resulting in an ROI of 250%.

When to Use: After project completion or periodically during the project to assess financial performance and justify continued investment.

36. Contribution Margin (CM)

Formula: CM = Revenue – Variable Costs

Purpose: To calculate the profit margin on sales after variable costs are covered, aiding in pricing and profitability analysis.

Application: Crucial for determining the profitability of individual items or services and for break-even analysis.

Real-World Example: Calculating the CM for a product with $150,000 in revenue and $90,000 in variable costs, resulting in a CM of $60,000.

When to Use: During pricing strategy development and financial planning to ensure products are priced to cover costs and generate desired profits.

37. Margin of Safety (MOS)

Formula: MOS = Current Sales – Break-even Sales

Purpose: To measure how much sales can fall before a project or company reaches its break-even point.

Application: Used to assess the financial safety buffer and risk level in sales volume.

Real-World Example: Calculating the MOS for a business with current sales of $500,000 and a break-even point of $300,000, resulting in an MOS of $200,000.

When to Use: In risk assessment and financial planning to understand and mitigate the risk of declining sales.

38. Cash Flow Formula

Formula: Cash Flow = Cash Inflows – Cash Outflows

Purpose: To monitor the net flow of cash into and out of a project to ensure liquidity.

Application: Essential for managing day-to-day financial operations and ensuring the project has sufficient funds to meet its obligations.

Real-World Example: Tracking the cash flow of a construction project, considering payments received from clients and expenses paid for materials and labor.

When to Use: Continuously, to ensure positive cash flow and prevent liquidity issues.

39. Working Capital Formula

Formula: Working Capital = Current Assets – Current Liabilities

Purpose: To assess the short-term financial health by comparing liquid assets against due liabilities.

Application: Used to measure a company’s ability to cover short-term obligations with its short-term assets.

Real-World Example: Calculating the working capital for a manufacturing firm with current assets of $1,000,000 and current liabilities of $700,000, resulting in a working capital of $300,000.

When to Use: Regularly, to ensure the company maintains sufficient liquidity to operate smoothly.

40. Payback Period (PP)

Formula: PP = Initial Investment / Annual Cash Inflow

Purpose: To determine how long it will take for an investment to pay back its original cost.

Application: Used to evaluate the time required to recover the initial investment in a project.

Real-World Example: Calculating the payback period for a solar panel installation with an initial investment of $100,000 and annual savings of $25,000, resulting in a PP of 4 years.

When to Use: In investment decision-making to assess the attractiveness of different projects based on their payback times.

| No. | Formula Name | Formula Description | Example Use Case | Purpose |

| 1 | Total Project Cost (TPC) | TPC = Direct Costs (DC) + Indirect Costs (IC) | Calculating total costs for a construction project | To determine the overall cost encompassing all direct and indirect expenses of a project. |

| 2 | Direct Costs | Direct Costs = Labor Costs (LC) + Material Costs (MC) + Equipment Costs (EC) | Estimating costs directly tied to project production | To calculate expenses directly associated with the production or execution of a project. |

| 3 | Indirect Costs | Indirect Costs = Overhead Costs (OC) + General & Administrative Costs (G&A) | Budgeting for non-project-specific costs | To estimate costs not directly chargeable to specific project tasks. |

| 4 | Overhead Costs (OC) | OC = Utilities + Rent + Depreciation + Taxes | Budgeting for ongoing operational expenses of maintaining a project site | To cover expenses necessary to support the project environment but not directly linked to tasks. |

| 5 | General & Administrative Costs (G&A) | G&A = Salaries + Insurance + Office Supplies | Planning the budget for project support staff and resources | To manage the general expenses associated with administering a project. |

| 6 | Labor Costs (LC) | LC = Wage Rate x Hours Worked | Calculating total labor costs for hourly workers | To determine the total cost of manpower for a project based on hours worked. |

| 7 | Material Costs (MC) | MC = Quantity of Material x Unit Cost of Material | Estimating the cost of materials required for a building project | To calculate the total expenditure on materials based on quantity needed and cost per unit. |

| 8 | Equipment Costs (EC) | EC = Depreciation + Maintenance + Operating Costs | Budgeting for machinery use in project | To account for the costs related to equipment usage, including upkeep and operation. |

| 9 | Budgeted Cost of Work Scheduled (BCWS) | BCWS = Planned Value (PV) | Project budgeting against scheduled work | To forecast the budgeted financial performance of project work scheduled to date. |

| 10 | Planned Value (PV) | PV = % Complete x Budget at Completion (BAC) | Progress reporting in project finance | To measure the value of work planned to be completed by a certain date in financial terms. |

| 11 | Budget at Completion (BAC) | BAC = Original Budget + Approved Change Orders | Setting the total budget post initial planning | To update the total project budget accounting for approved changes. |

| 12 | Actual Cost of Work Performed (ACWP) | ACWP = Actual Costs (AC) | Tracking actual spending against budget | To monitor the actual expenditure on project work performed to date. |

| 13 | Actual Costs (AC) | AC = Direct Costs Incurred + Indirect Costs Incurred | Tracking real-time spending on project tasks | To calculate the total actual spending, combining both direct and indirect costs. |

| 14 | Earned Value (EV) | EV = % Complete x Budgeted Cost of Work Performed (BCWP) | Performance measurement for project budgeting | To assess the value of work actually completed compared to the planned budget. |

| 15 | Budgeted Cost of Work Performed (BCWP) | BCWP = % Complete x BAC | Evaluating financial performance against the baseline budget | To measure the financial value of work actually completed against the total budget. |

| 16 | Cost Variance (CV) | CV = EV – AC | Identifying discrepancies in budget vs actual spending | To find the difference between the earned value and the actual costs. |

| 17 | Schedule Variance (SV) | SV = EV – PV | Assessing timeline adherence in project management | To compare the earned value against the planned value to find timing or scheduling issues. |

| 18 | Cost Performance Index (CPI) | CPI = EV / AC | Measuring cost efficiency of project execution | To determine the cost efficiency of the project work by comparing earned value to actual costs. |

| 19 | Schedule Performance Index (SPI) | SPI = EV / PV | Evaluating progress efficiency against the project plan | To assess the efficiency of project progress relative to the schedule. |

| 20 | Estimate at Completion (EAC) | EAC = BAC / CPI or AC + (BAC – EV) | Forecasting total project costs based on current data | To predict the total cost of the project at completion, considering current performance. |

| 21 | Variance at Completion (VAC) | VAC = BAC – EAC | Anticipating potential budget overruns or savings | To forecast the potential difference between the budget at completion and the estimated completion costs. |

| 22 | To-Complete Performance Index (TCPI) | TCPI = (BAC – EV) / (BAC – AC) | Planning required cost performance to meet budget targets | To determine the cost performance needed to complete the remaining work within the budget. |

| 23 | Cost Estimation Formula | Y = a + bX, where Y is estimated cost, a is fixed cost, b is variable cost per unit, X is number of units | Estimating total project costs based on units produced | To calculate estimated costs based on fixed and variable components for unit-based projects. |

| 24 | Break-Even Point (BEP) | BEP = Fixed Costs / (Selling Price per Unit – Variable Cost per Unit) | Determining the sales point at which costs are recovered | To calculate the sales quantity needed to cover all costs and start generating profit. |

| 25 | Return on Investment (ROI) | ROI = (Net Profit / Cost of Investment) * 100 | Evaluating the profitability of an investment | To measure the percentage return on the funds invested in the project. |

| 26 | Gross Profit Margin (GPM) | GPM = (Revenue – Cost of Goods/Service Sold) / Revenue * 100 | Analyzing profitability of product sales | To determine the percentage of revenue that exceeds the cost of goods sold. |

| 27 | Net Profit Margin (NPM) | NPM = Net Profit / Revenue * 100 | Measuring profitability relative to total revenue | To gauge the percentage of revenue that remains as profit after all expenses. |

| 28 | Contribution Margin (CM) | CM = Revenue – Variable Costs | Assessing profitability of individual items or services | To calculate the profit margin on sales after variable costs are covered. |

| 29 | Margin of Safety (MOS) | MOS = Current Sales – Break-even Sales | Evaluating financial safety relative to break-even point | To measure how much sales can fall before a project or company reaches its break-even point. |

| 30 | Cash Flow Formula | Cash Flow = Cash Inflows – Cash Outflows | Managing the cash balance of a project | To monitor the net flow of cash into and out of a project to ensure liquidity. |

| 31 | Working Capital Formula | Working Capital = Current Assets – Current Liabilities | Calculating liquidity for short-term financial health | To assess the short-term financial health by comparing liquid assets against due liabilities. |

| 32 | Payback Period (PP) | PP = Initial Investment / Annual Cash Inflow | Assessing the time required to recover an initial investment | To determine how long it will take for an investment to pay back its original cost. |

| 33 | Discounted Payback Period (DPP) | DPP = Initial Investment / (Annual Cash Inflow x Discount Factor) | Calculating time to recover investment considering time value of money | To measure the time to recoup the initial investment with the present value of cash inflows. |

| 34 | Net Present Value (NPV) | NPV = Sum of Present Values of Cash Inflows – Sum of Present Values of Cash Outflows | Decision making in project investments | To calculate the difference between the present value of cash inflows and outflows over the project’s life. |

| 35 | Internal Rate of Return (IRR) | IRR = Discount Rate at which NPV = 0 | Evaluating the profitability of potential investments | To identify the discount rate that makes the present value of future cash flows equal to the initial investment. |

| 36 | Cost of Capital (WACC) | WACC = (E/V * Re) + (D/V * Rd * (1 – Tax Rate)) | Determining the average cost of financing company’s capital | To assess the cost of a company’s financing sources: equity and debt. |

| 37 | Return on Investment (ROI) | ROI = (Net Profit / Cost of Investment) x 100 | Calculating the efficiency of various investments | To assess the gain or loss generated on an investment relative to its cost. |

| 38 | Contribution Margin (CM) | CM = Revenue – Variable Costs | Determining the profitability of sales | To measure how much of the revenue is retained as profit after variable costs. |

| 39 | Margin of Safety (MOS) | MOS = Current Sales – Break-even Sales | Planning for risk in sales volume | To determine how much sales can decrease before the business incurs a loss. |

| 40 | Cash Flow Formula | Cash Flow = Cash Inflows – Cash Outflows | Evaluating financial stability of operations | To assess the net amount of cash generated or used during a period in project operations. |

Leave a Reply

You must be logged in to post a comment.